cares act illinois student loans

Home Unlabelled Cares Act Illinois Student Loans - Financial Aid Eastern Illinois University. TOTAL Amount of Fund Disbursed to Students as of 11302020.

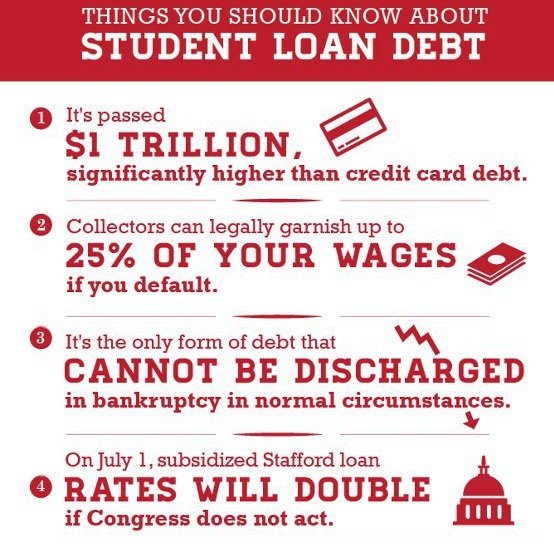

What Happens If I Can T Pay Student Loans Debt Com

Illinois State will use all of the funds received from the student portion 8060711 to provide CARES Emergency Financial Aid.

. Allocates 25 billion in federal transit formula funding to keep public transit operating throughout Illinois in order to ensure continued access to jobs medical treatment food and other essential services. Illinois transit agencies will receive an estimated 16 billion in federal. Illinois State University has signed and returned to the US.

Department of Education the Certification and Agreement forms for both the student portion 50 and the institutional portion 50 of CARES Act funds. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees student loans has been extended from the previous deadline of December 31 2020 to December 31 2025. Employer student loan assistance got some love in the CARES Act.

In the meantime isac and the state of illinois have worked to mitigate hardships for student borrowers with other federal loans not covered by the cares act. Department of Education Department. So you wont be charged anything on your student loans until May 2022 not even interest paymentsbut youre still able to keep paying on them if you want.

Illinois residents who are struggling to make student loan payments could soon get some relief. There are many benefits to student borrowers due to the CARES Act. Illinois Central College received their Coronavirus Aid Relief and Economic Security CARES Act funding for students and is beginning to distribute funds to students.

Covers approximately 95 of borrowers excludes federal debt held by private companies Federal Family Education Loan program and federal debt held by colleges and universities. The college expects to complete the distribution of16 million to over. Under the CARES Act theres currently a 0 interest rate for.

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. Student Loan Debt. This order suspended all payments on Direct Loans through December 31 2020.

But thats not all. Once youve decided to go to college understanding how student loans work is the next big step. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020.

The CARES portal can be found at httpscaresapphfsillinoisgov. ESTIMATED TOTAL of Title IV Eligible Students. One component of this relates to when students have to repay their debt.

Under the new law no payments are required on federal student loans owned by the US. Student loans and wage garnishments under the cares act. Heres how it works.

Sunday December 26 2021. This law also waives student loan interest on qualifying federal student loans through September 30 2020. Cares act illinois student loans.

The portal is open from September 29 2020 through noon on Saturday October 31 2020. TOTAL Number of Students who have to date received payment of an Emergency Financial Aid Grant to students under Section 18004 a 1 of the CARES Act. So if your loans are eligible you can stop paying your student loans through September 30 2020.

Department of Education between March 13 2020 and May 1 2022. Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. This bill allotted 22 trillion to provide fast and direct economic aid to the American people negatively impacted by the COVID-19 pandemic.

The cares act the sweeping stimulus legislation enacted in march includes relief for student. Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act. Section 18004c of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for expenses related to the disruption of campus operations due to the coronavirus including eligible expenses under a students cost of attendance such as food housing course materials technology.

The CARES Act and Employer Student Loan Contributions Update 1227. But under the CARES Act all federal student loans have been automatically placed in forbearance. Elementary and Secondary School Education Relief Fund April 23 2020.

FAQs on maintenance-of-effort requirements June 5 2020 Formula grants under the CARES Act for the Outlying Areas May 5 2020 ESF Discretionary Grants April 27 2020 CARES Act. Of that money approximately 14 billion was given to the Office of Postsecondary Education. Student Loan Scams 3 Warning Signs To Watch For Money Tell The Department Of Education To Fix Public Service Loan Forgiveness And Deliver On The Promise Of Debt Relief For The Legal Services Community Student Loan Borrowers Assistance.

Critically neither Perkins Loans nor commercially-held FFEL loans are covered. Pritzker said the state has secured relief options for student loan borrowers who werent previously covered by the federal CARES Act which provides relief to those with federal loans but not to those with private loans or federal loans not owned. HFS will make final funding and policy decisions based on federal and state laws regulations and guidance.

Most provisions apply only to Direct Loans and Federal Family Education Loans FFEL loans currently owned by the US. The CARES Act includes several provisions that apply to certain loans owed by some federal student loan borrowers. In addition the interest on these federal student loans will automatically drop to zero percent.

Before the CARES Act passed ICC began assessing student needs and planning for the distribution of these federal funds. A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. Department of Education for six months.

Students with federal student loans. The CARES Act allows employers to pay up to 5250 toward an employees student loans tax-free through the end of 2020. The CARES Act wants to make those payments more manageable in times like now.

Cares act illinois student loans Monday January 10 2022 Edit. However the CARES Act left out millions of student loan borrowers with federal loans that are not owned by the US Government as well as loans made by private lenders. Under this new initiative Illinoisans with commercially-owned Federal Family Education Program Loans or privately held student loans who are struggling to make their payments due to the COVID-19.

Suspends student loan monthly payments for 6 months. Pritzker said this newly approved. HFS will consider the amount of COVID-related funding providers are receiving.

The Coronavirus Aid Relief and Economic Security CARES Act provides additional flexibility for student loan borrowers during the Coronavirus Outbreak including automatically suspending. The CARES Act suspends payments on all federal student loans held by the US.

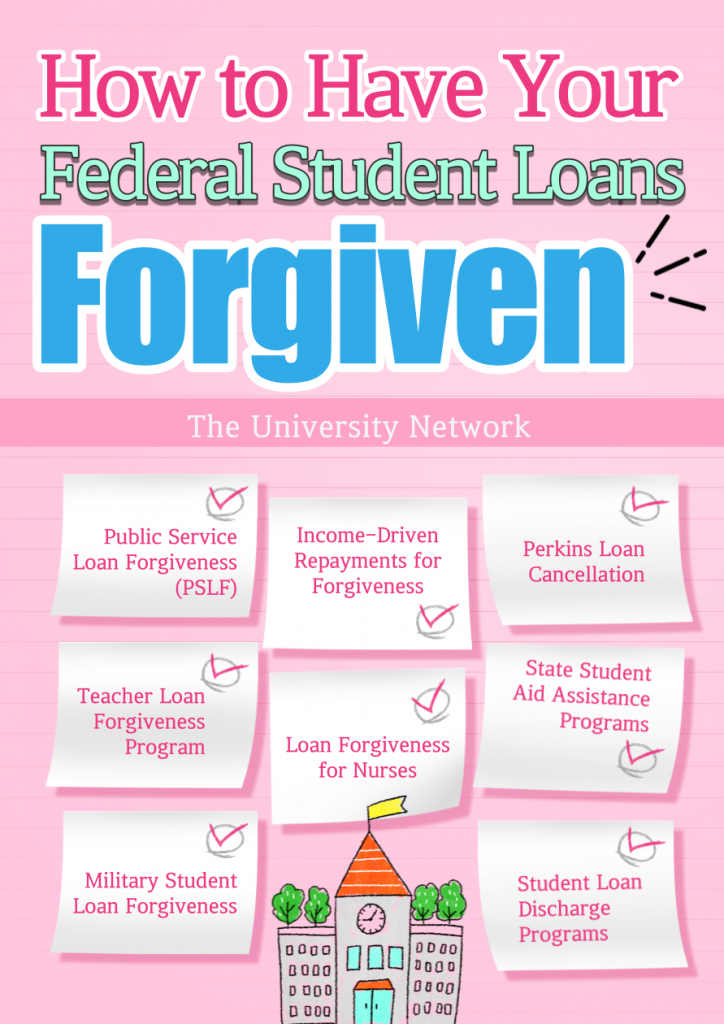

The Full List Of Student Loan Forgiveness Programs By State

How To Get A Student Loan Money

Student Loan Discharge Options To Cancel Your Federal Student Loans Student Loan Hero

Student Loan Debt Relief Program Made Easy As Covid 19 Relief Ends

Student Loan Forgiveness Programs Credible

6 Best Student Loans Of 2021 Money

Student Loan Company To Cancel 1 7b In Debts Under Predatory Loan Settlement Newsnation Now

How To Have Your Federal Student Loans Forgiven The University Network

Student Loan Debt Relief Program Made Easy As Covid 19 Relief Ends